Lesson 7b: Money and Monetary Policy

Debbie Henney, FTE Director of Curriculum Receives Bessie B Moore Service Award

Foundation for Teaching Economics is proud to announce that Debbie Henney, director of curriculum for the Foundation for Teaching…

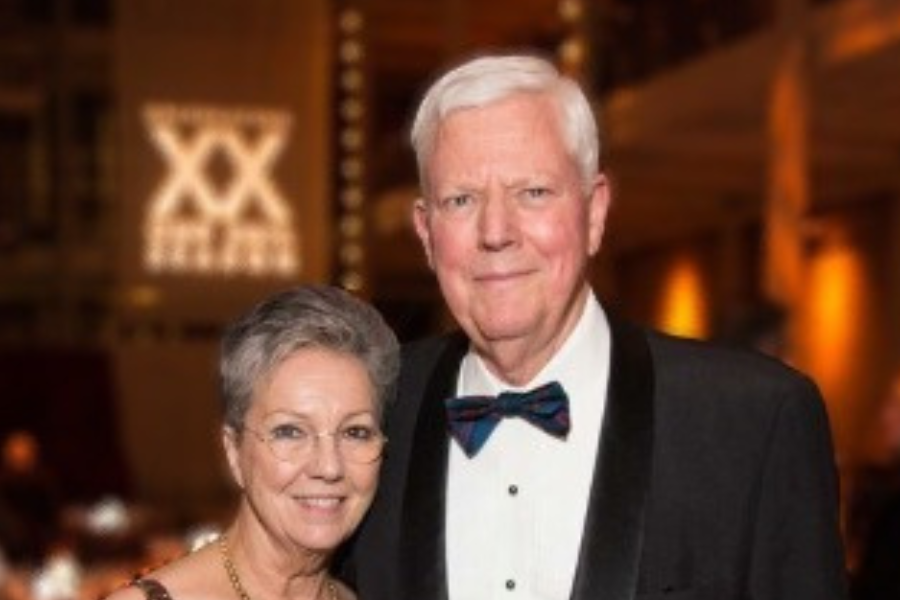

FTE Pays Tribute to Jerry Hume

It is with deep sadness that we announce the loss of William J. Hume, known as Jerry Hume, former Chairman…

Why We Should Be Teaching Students Economic Literacy

Ted Tucker, Executive Director, Foundation for Teaching Economics October 26, 2022 More high schools are offering courses on personal finance…