Teacher Guide

- >

- Teachers

- >

- Teacher Resources

- >

- Lesson Plans

- >

- Issues of International Trade

- >

- Lesson 2 Activity: U.S. Sugar Policy

- >

- Teacher Guide

Class Discussion: Is U.S. Sugar Policy A Sweet Deal?

1. Is sugar policy a sweet deal for the U.S. government?

- Refer to the background reading for the benefits of sugar policy to the federal government. Benefits include revenue, foreign trade influence, and political support from farmers.

2. Is sugar policy a sweet deal for consumers and producers in the sugar market?

- The policy generates huge benefits for sugar growers. It is not a sweet deal for consumers who bear the higher costs of sugar. (Note that the benefits of the policy are relatively concentrated and therefore noticeable to each individual producer, while the costs are diffuse and therefore not very noticeable to individual consumers.)

- Hints: Use your common sense and your experience to answer the following:

- If you are a buyer of sugar, would you rather there be more sugar or less sugar on the market? Why? (Hint: What do you think happens to the price of sugar when there is more sugar available? When there is less sugar available?) Buyers want there to be more sugar on the market as that will generate downward pressure on prices.

- If you are a seller of sugar, would you rather there be more sugar or less sugar on the market? Why? (Hint: What do you think happens to the price of sugar when there is more sugar available? When there is less sugar available?) Sellers want less sugar on the market, because that which is available – theirs – will sell for a higher price.

3. What trade-offs must be considered in the decision about whether or not to impose sugar trade barriers?

- Are the foreign policy advantages worth the costs that are imposed on U.S. consumers and on the world’s producers of sugar? Students may also look at the more personal question that elected officials must face: Are the advantages of support from groups supporting the sugar quota worth the costs those quotas impose on consumers?

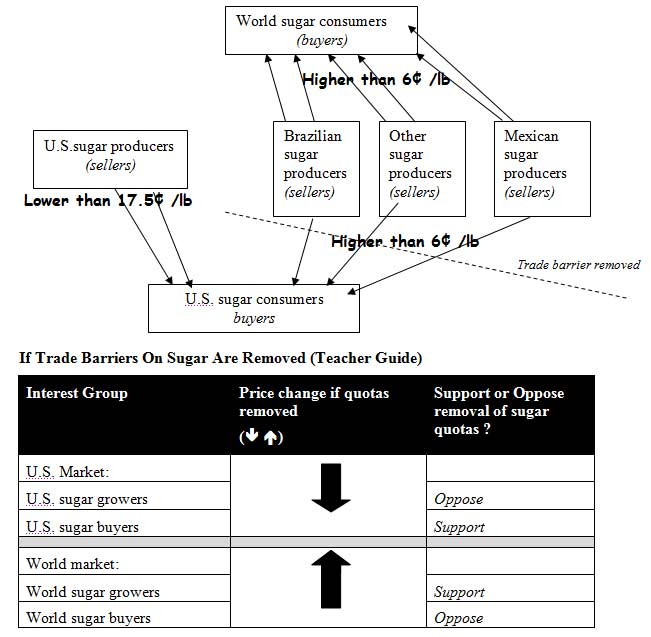

Diagram 2

Diagram 2 should be completed as follows to show the effect of removing the tariff. Note that the world price of sugar will rise above 6¢ as some is diverted to U.S. buyers and the U.S. price will fall in response to foreign competition.

A. Sugar policy is a sweet deal for sugar growers.

B. The policy has lasted because of the distribution of benefits and costs. The concentrated benefits give growers an incentive to lobby Congress to make sure the benefits continue. Meanwhile, the costs to individual consumers are too low (and not clearly apparent) to provide any incentive to organize in opposition.

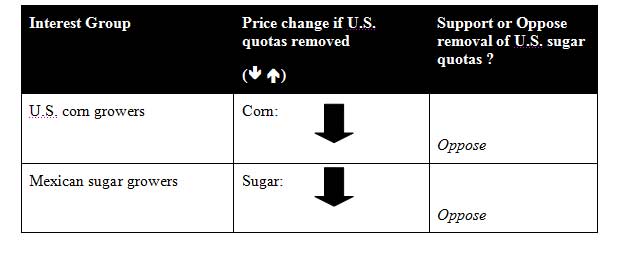

Current events and the sugar market: (Teacher Guide)

U.S. corn growers benefit from the higher domestic price of sugar because demand increases for corn-based sugar substitutes.

Mexico, once an opponent of U.S. sugar import restrictions, is now a supporter because NAFTA makes Mexican growers no longer subject to the quota. Thus, Mexican sugar producers benefit from the fact that the U.S. price is higher than the world price.

Additional Teacher Notes: Charts in student exercise

In considering the answers in the chart, it is important to think about the role of supply, demand, and price in the sugar market, the markets for products that use sugar and sweeteners, and the markets for alternatives to sugar like high fructose corn syrup.

U.S. farmers will favor the continuation of quotas because they keep the domestic price of sugar high. The quota is set so that there is just enough sugar to meet the demand at a relatively high price. If the price starts to fall, the quota for foreign producers is reduced.

World sugar farmers favor the removal of quotas that shut them out of the U.S. market. Understandably, they’d love to offer their sugar in a market with a price above that they face in the world market. From their point of view, even if the entry of foreign sugar caused prices in the U.S. market to fall, they’d still be above current prices on the world market.

If U.S. consumers thought about it, they would favor the removal of quotas. No quotas means more sugar offered on the market, which means lower prices. (However, as noted in the exercise, sugar consumers have little incentive to engage in the organized activity necessary to bring about the removal of quotas.)

In the short run, world consumers benefit from the continuation of quotas because without the U.S. demand in the world market prices of sugar and sugar products remain fairly low. If the quotas are removed the world price will undoubtedly rise, affecting, at least in the short run, the food budgets of many poorer people in third world countries.

U.S. corn farmers also benefit from sugar quotas because the demand for alternatives to high priced domestic sugar, such as high fructose corn syrup, helps keep the price of corn high.

World corn farmers should favor the removal of quotas because the rise in world sugar prices would increase the demand for sugar alternatives in countries other than the U.S.

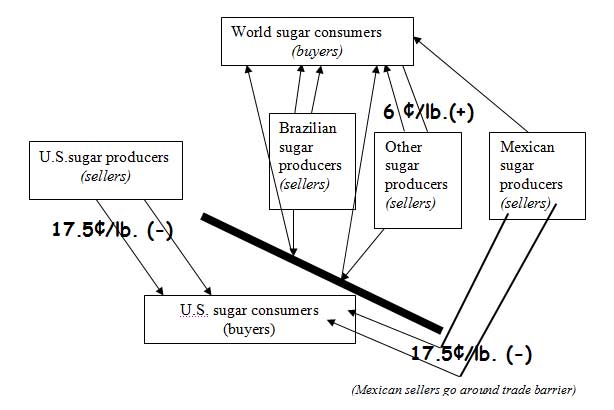

Mexican sugar farmers favor the continuation of the quotas because under the NAFTA agreements they can export large quantities of sugar to the higher priced U.S. market. (On the overhead transparency of diagram 1, show the Mexican arrows sliding around the end of the trade barrier.)

Concentrated benefits, diffuse costs:

The primary reason that sugar quotas continue to be used by the U.S. is the benefit that they bring to the approximately 10,000 U.S. sugar farmers. Simply put, the benefit to each of the farmers is far greater than the cost to each U.S. consumer who pays higher prices for sugar and sugar products each year. The incentive for the farmers to lobby Congress and engage in public relations campaigns is very strong; even the growers at the lower end of the range have a $40,000 benefit from the policies. For any given consumer, however, the effort to lobby Congress to remove the quotas or to launch a public relations campaign aimed at quota removal is simply not worth the benefits – approximately $10-$20 each year – that lower sugar prices would bring.

Why Would They DO That? (Teacher Guide)

The domestic price of sugar was so high that it was profitable for the companies to buy the cake mixes, bear the cost of extracting the sugar, and then sell the sugar. The Canadian cake mixes were produced relatively inexpensively with sugar purchased at 3¢/lb. Because of U.S. – Canada trade agreements, no quota stopped the mixes at the border. U.S. producers found that even the expense of extracting the sugar from the cake mixes was cheaper than paying the domestic price of sugar.

Debbie Henney, FTE Director of Curriculum Receives Bessie B Moore Service Award

Foundation for Teaching Economics is proud to announce that Debbie Henney, director of curriculum for the Foundation for Teaching…

FTE Pays Tribute to Jerry Hume

It is with deep sadness that we announce the loss of William J. Hume, known as Jerry Hume, former Chairman…

Why We Should Be Teaching Students Economic Literacy

Ted Tucker, Executive Director, Foundation for Teaching Economics October 26, 2022 More high schools are offering courses on personal finance…